When the current Port Covington developer Marc Weller with Sagamore Development steps down and two new national developers take his space, its big news. But is it good news?

The Baltimore SUN took cues straight from Sagamore's press release and made it sound as if the two new firms will "join" Weller/Sagamore:

"Two developers of high-profile urban projects in major U.S. cities have joined Sagamore Ventures’ effort to create a mini-city in South Baltimore’s Port Covington and will lead the next phase of development".(Baltimore SUN May 10, 22)

But the BBJ 's take a bit later, was far more explosive. Port Covington master developer Weller will no longer lead the 235-acre project, in fact, he will not be part of the team at all. He will even be moving his headquarters out of Baltimore.

|

| Current state of construction "Chapter One" (SUN photo) |

"The company will be replaced this month by MAG Partners and MacFarlane Partners, a team of national developers and investors, who will launch an immediate marketing and leasing campaign for the five office, retail and residential buildings now under construction at the South Baltimore site". (BBJ 5-10-22)

Goldman Sachs, financial partner on the development team will remain. Goldman asset management director Michael Lohr was quoted in the press release:

“The growing development team reflects both our ambition for Port Covington and commitment to delivering a world-class project that will drive renewed community investment and revitalize South Baltimore’s waterfront”

The Weller Development website still lists his company as the master developer for Port Covington and Weller reportedly will stay involved with finishing the current construction. Weller Development was founded around Port Covington. Most of the company's deals are related to the Plank brothers Kevin and Scott. Weller projects include the Sagamore Pendry Baltimore hotel, Sagamore Spirit Distillery, Rye Street Tavern, City Garage, the management of the Reston National golf course in Northern Virginia and 3150 M Street NW building in Washington's Georgetown.

|

| A new set of partners: Plank, Gilmartin, MacFarlane (Ryb pictures) |

Weller's stake at Port Covington is significant: The "Chapter 1B" complex currently under construction entails more than 1.1 million square feet of development with 586,000 square feet of residential, 440,000 square feet of office,116,000 square feet of retail, over 1,000 parking spaces, and ten acres of parks and public space.

For this phase Weller has drawn the first tranche of $148 million from the city tax increment financing (TIF) bonds in 2019. The existing financial terms will remain in place according to sources in the development team. The new partners see themselves as additional direct investors and will initially focus on finding tenants for the constructed buildings.

The new situation is likely to revive the discussion about the redevelopment of Port Covington ("we build it together") which has been a hotly debated topic for at least 7 years since then Under Armour CEO Kevin Plank announced his plans to move to Port Covington and build "global headquarters" there that would be part of an entire new town.

"It will be one of the most incredible places to work, to live and to play," Plank said in an interview at his office overlooking the Inner Harbor. "It would feel like an old port city, and the ability for us to go from the ground up to do that will be just incredible." (Kevin Plank in March 2015)

Since then a lot has happened. While the City's giant tax increment financing bill succeeded against some vehement opposition, Under Armour's incredible growth streak came to an end amidst accusations that the company's growth had been inflated. Still, the community benefits agreements with six surrounding communities (SB 7) was in effect, it was honored and the development team provided resources for improvements. The overall development area was divided into the 50 acre Under Armour headquarters territory and the remaining 235 acres of Port Covington with Weller/Sagamore at the helm. The developers like to see these as separate even though Kevin Plank cleared used to have a stake in both. Weller plowed forward, first with a competitive entry into the "who gets Amazon" sweepstakes that Baltimore lost badly. Then with "Chapter 1B" envisioned as the seed for "Cybertown", a cluster of know-how in cyber security, fueled by the global risks of hacking and the local presence of the nearby NSA. That bubble burst as well, when the lead cyber tenant did renounce his move to Port Covington.

Then the global pandemic struck and made office space a surplus commodity. To this day it is unclear if the bulk of employees will ever return to their cubicles. Still, Weller continued with mixed use buildings dubbed "Chapter 1 B" on a speculative basis, especially the significant amount of office space posing quite a risk. Optimistic outlooks were regularly published. However, to this day, shortly before the buildings are slated to open, apparently no offices have been leased.

Another big change in Port Covington was that Plank himself shrunk his headquarters plans beyond recognition. What had been giant gateway signature towers along I-95 became a suburban agglomeration of low flung stuff, including retaining the former Sam's Club warehouse. UA was now assuming that it would keep a hybrid workforce for the foreseeable future, drastically reducing the need for in person office space.

|

| UA HQ as presented to UDAAP this month (UA website) |

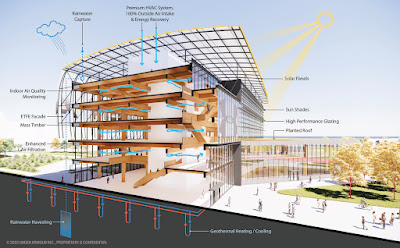

Yet the move towards a new Under Armour campus is underway. In March Under Armour presented a fairly unassuming first phase to UDAAP for review. Design by Gensler, Baltimore. Then, last week new headquarters plans were presented for design review. The plans now showed a more impressive 280,000 sf structure with much glass. (For a more detailed description see here).

As before, the project was described in superlatives. This time the design which is slated to entail geothermal heating and cooling and a mass timber structure clad in a heat resistant glass was described as the most sustainable project in the region.

“TMB2 represents Under Armour’s commitment to providing our teammates with an innovative, collaborative and flexible work environment that supports our hybrid work philosophy,” said Under Armour President and CEO Patrik Frisk. “Consistent with one of our values to ‘Act Sustainably,’ TMB2 speaks to our focus on performance, consumers, the planet, and the community we call home.” (website)

The two development areas are assumed to continue in lockstep. Outside the campus there are still some 190 or so acres to be developed. This will now be the task for the new development partners.

The new developers, MAG Partners, a woman owned company founded in 2020 in New York City and MacFarlane Partners, a black-owned company, headquartered in San Francisco would continue to honor all SB7 community benefits obligations.

Both new partner firms are new to Baltimore. MaryAnne Gilmartin, CEO of MAG previously served for 15 years as Vice President and President and CEO of Forest City Ratner Companies, a company who lead the EBDI development team. Victor MacFarlane, holding a masters in business and a law degree, founded his company in 1987 but reinvented the company a few times since then.

|

| Sustainability through mass timber (Gensler graphic) |

MAG will be the managing partner. Some staff of Weller's company have switched to MAG in their old role, presumably ensuring institutional memory and some continuity

Aside from their excitement of coming to Baltimore, there has been no announcement from the new partners about additional development on the remaining site or what overall long-term vision they may have for this "new town" inside Baltimore.

The Mayor and the chair of the SB7 coalition were both quoted in Sagamore's press release singing the praises of the leadership new arrangement. They may know more than the public; the news of an entirely new out-of -town development team taking over the largest redevelopment project in Baltimore could, indeed, be the excellent news as which it is presented. However, with everything that is riding on this project, starting with the $128 million TIF bonds, scrutiny by the Baltimore Development Corporation (BDC), the Mayor and the Council would be warranted.

However, according to BDC Vice President Clark, BDC is not in charge of reviewing the project, it’s progress and financing, or the collection of bond repayments. This would be the responsibility of the Board of Estimates and the Maryland Economic Development Corporation (MEDCO) which issued the bonds. BDC believes in the project, sees no reason for concern and considers the change a positive development.

Seven years after Plank outlined his vision in 2015, it is still in large part an aspiration. But unlike some other big projects in Baltimore, Port Covington has seen some real change. In 2015 Plank said "We do have an image problem in Baltimore and we could do something great and iconic and have people see it and be visible. I think the combination between Under Armour and Baltimore right there under 95 will be incredibly powerful." This potential is still there. The vital catalyst, though, may be the new Middle Branch plans developed by New York's Field Operations, not Under Armour.

Let's see what happens next.

Klaus Philipsen, FAIA

Updated 5/19/22 for statements from BDC.

Related on this blog:

Port Covington - on course or a vanishing dream? April 21