In her signature suite and bow-tie outfit Housing Commissioner Alice Kennedy laid out her many responsibilities in front of a room full of developers, investors, former and current administrators including her former boss, Paul Graziano who had placed himself modestly into the last row. Only when it came to the few daycare centers which for some odd reason DHCD still runs but tries to get rid off, did she briefly refer to Graziano by saying "he would know something about that topic". This wasn't meant to imply he wouldn't know about the other topics, still this interpretation briefly lingered in my head, before her forward looking presentation recaptured my attention. Many good things seem to be in the offing, many having to do with efficiency of the nearly 400 employee department itself, whether it is for permits or the release of federal grant money to small local recipients who suffer because payments take forever.

|

| Alice Kennedy explaining the puzzle pieces |

But one thing, especially caught my attention: The Buy Into B'more initiative that had just been announced together with a $100 million infusion into Baltimore affordable housing initiatives. $39 million are supposed to go into addressing vacant homes, in part motivated by the tragedy of three fire fighters dying in a vacant home that caught fire earlier this year. (See Mayor's press release)

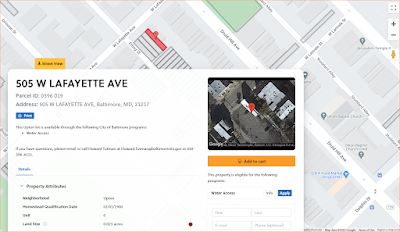

From O'Malley's push for 5000 homes to be eliminated from the vacants list to "Vacants to Value" (Rawlings Blake), to Brandon Scott's "Buy into Bmore" the list of Baltimore Mayors trying to reduce Baltimore's 15,000 vacant homes in City possession is long and complete. Yet, thanks to a steady flow of new abandonment the 15,000 vacant homes remained as a figure that didn't budge. Alice Kennedy said that the properties are now offered on a dynamic website that would function much lake MLS listings proliferated by the real estate portals of Zillow, Redfin and Trulia. Indeed, anyone used to Baltimore's clunky turn of the century style websites for payments, permits and rental licenses will be surprised about how smoothly and elegantly the site operates. The main features are a set of filters through which one can select what type property in which area one is looking for and a map that shows all available properties or those that match the filters. The map can be enlarged to the point that it shows individual parcels which can be clicked for parcel number and a photo and additional info from the SDAT records.

|

| Vacants can be an imminent danger |

It is questionable that a more fluid and modern access to the vacants database will make those go away or lead to a stampede of buyers. However, the added transparency should help avoid behind the scenes preferential treatment where certain entities seem to have had early access to data, an item that was rumored to have caused the sudden and then surprising demise of the previous Commissioner in 2016. For better or worse, the large amount of investor money which had been sloshing around the globe and that had contributed to overheated real estate markets in many larger US cities left Baltimore if not untouched, but relatively cool. While real estate values improved here also, the 18% gain is small compared to boom cities such as Austin (56%) San Diego (34%) or even places such as Cincinnati, Cleveland or Columbus, OH (26, 25, 24%).

One of Baltimore's revitalization problems appears to be a lack of focus resulting from policies that oscillate between "building from need" (Schmoke) and "building from strength" (O'Malley). It isn't entirely clear where Mayor Scott lands on this matter, but his Planning and Housing departments jointly support setting investment priorities as spelled out in the Baltimore "Impact Investments Zones". Those zones can also be selected as one of the filters in the Buy Into Baltimore maps. The Impact Investment Zones are based on anchor institutions and areas of strength from which to build up.

The strategy of prioritizing investments in areas that have a chance of being turned around, often due to strong anchor institutions had been created by Mayor Pugh and goes back to papers that circulated during the O'Malley time. The problem is that this strategy can easily conflict with a focus on equity and social justice . The conflict amounts to the tension between economic strategies and ethical and moral strategies that are less based on market economics and more on making up for past injustices. For sure, the two approaches are not mutually exclusive and wealth creation in disadvantaged populations is an example of overlap.

|

| Screenshot of Buy Into B'More |

A current case that illustrates the conflict is Council President Mosby's "Dollar House" bill which focuses on the formerly redlined communities in the "Black Butterfly" and which is stalled in city council because of economic arguments. That is to say that many council members follow Alice Kennedy's line of reasoning. She testified when the bill was up for debate, that the offered support is too little in deeply disinvested areas and would leave new property owners stuck with property that is valued nowhere near what it cost to fix them up. The eligible properties are also scattered and not consolidated as in the original Dollar House program. The matter is currently unresolved and proves that good intentions are not sufficient to achieve the desired outcomes.

Kennedy who had worked in Baltimore's Planning Department before switching to Housing sees the bigger picture with its connections between housing and health, economic development, safety and even education. (see her talk about this in the Video: "Engaging all pieces of the puzzle"). Kennedy has begun to dismantle the silo mentality in which city agencies often still operate, in spite of all the previous aspirations to the contrary. Kennedy sets especially on closer collaboration with the Planning Department which puts the annual capital budget together.

|

| Screenshot of Buy Into B'More |

Her broader view leads her to switch the focus away from vacant house reduction through demolition to avoiding vacant houses in the first place, i.e. through prevention. In that, she looks for upstream interventions similar to what Mayor Scott promotes as a necessity for combating crime. This makes good sense: Once a house stood vacant for an extended time, the fix is much harder than if one can prevent it from becoming vacant.. To this end Kennedy collaborates with the Green and Healthy housing initiative on the use of a part of the $39 million dollars for stabilization and improvement of homes that are occupied by low income residents in deeply disinvested areas as owners or as renters. Even owners can't get a simple home improvement loan because of lack of sufficient equity. Housing strategies must lift up the home values of entire neighborhoods, or investments will remain money down the drain in which the cycle of improvement and vacancy will churn indefinitely.

Klaus Philipsen, FAIA