|

| The wrong game all along? EBDI today (Photo Philipsen) |

"For many months, we have been working with a range of civic organizations, all of which want to work collaboratively with the City to create positive change in East Baltimore. This working group includes the Baltimore Urban League, Citizen’s Planning and Housing Association, Environmental Defense, the Job Opportunities Task Force, AIABaltimore, Preservation Maryland, and the Save Middle East Action Committee. Together we have put forth a shared vision for the future."Brad Rogers who spoke on behalf of the 1000 Friends of Maryland then continued:

"Let me tell you what that looks like.

Together, we envision a Biotech Park that is integrated into the fabric of East Baltimore, removing the sense that there is a wall between Johns Hopkins and the surrounding community. In addition, it should creatively incorporate historic buildings into to a design that reflects the city’s rich cultural heritage.

We envision an efficient and coordinated transportation system that makes the Biotech Park more attractive to tenants, links the neighborhood to jobs, and protects residents from traffic and air pollution. In particular, we would like to see the Madison Square rail hub become a catalyst for transit-oriented development, opening up new opportunities for locally owned businesses. We certainly think that we can do better than just dropping 7,000 new parking spaces into a residential neighborhood.

From an exhibit by E. Barbush.

Barbush standing in the wasteland of over 1000 demolished houses

We envision a variety of new and rehabilitated homes, so that people from a range of different incomes can live comfortably in East Baltimore. Local residents, who have stuck by their neighborhoods through hard times, should be able to benefit from redevelopment when it happens, and East Baltimore must become a place where citizens of all races will have access to opportunity.

Finally, we envision a redevelopment process that minimizes the hardships of relocation on residents, and that treats all citizens with justice and equity in accordance with fair housing principles."

Middle East had been one of the most disinvested areas in the City. Houses were small and in bad shape, some entire blocks stood vacant. From 37,000 people in 1970, the population dropped by a bit more than half by 2,000. Homeownership was a low 18% and the poverty rate was 48%, twice the City average. However, later, in 2009, the book Middle East Baltimore Stories: Images and Words from a Displaced Community seeks to dispute this narrative of despair with an emphasis on the people network that existed in Middle East, the less tangible thing we often call "human capital".

The Historic East Baltimore Action Committee (HEBCAC) had been created in 1994, but after six years their work was deemed insufficiently successful and officially replaced. The new concept was "building from strength", a brainchild of mayoral advisor Paul Brophy, inspired Martin O'Malley to integrate the concept into his tough on crime strategies.The selected approach with the hospital as the element of strength needed a backstop on the northern end, so as to make the revitalization area well defined and not endless. Thus the Amtrak tracks on a berm swinging through east Baltimore in a wide arc, became the boundary, the resulting shape giving the 88 acre redevelopment area its nickname: the (grand) piano.

This is gentrification – a big institution pushing out a vulnerable community for its benefitLawrence Brown, coiner of the term "Black Butterfly" as quoted in the Guardian)

Seeing Hopkins as the engine had the baked-in flaw, that the East Baltimore residents had a deep seated distrust in Hopkins, seeing it more as a menace than a source of strength that could lift their neighborhood. Too long had Hopkins neglected to see their neighbors as anything they should care about. Instead people there became at times guinea pigs. Thus the announcement of big comprehensive action with Hopkins as a partner was met with no enthusiasm especially since residents were still not really seen as partners. This motivated Marisela B. Gomez, a resident in Middle East but also an academician with a PhD and MD from Johns Hopkins and others to found the Save East Baltimore Action Committee (SMEAC) to represented the interest of existing residents as community activists. Gomez provided a particular perspective of the longstanding conflict between the community and the famous hospital. SMEAC was disbanded in November 2009 and was later replaced by the Baltimore Redevelopment Action Coalition for Empowerment (BRACE). Gomez sees the EBDI plan mostly as an effort of Hopkins to "expand their walls".

|

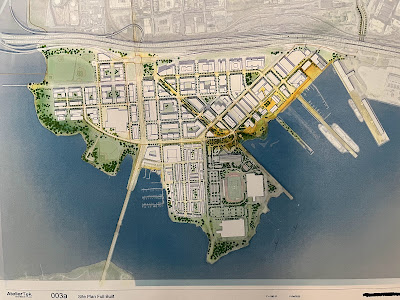

| EBDI Masterplan 2006 with preserved houses in red |

Going big with built in defects

Aspirations for "fixing" Middle East were big in every aspect. Support for going big was broad as this list of partners shows: Institutional partners in the East Baltimore Development Initiative (EBDI) have been Johns Hopkins University, the Annie E. Casey Foundation, the Weinberg Foundation, Forest City as master developer, (now Brookfield Properties), the City, the State, the Goldseker Foundation, the Abell Foundation, the Greater Baltimore Committee, and ReBuild Metro. The fuel for going big was supposed to come from a Hopkins biotechnology park and "life sciences", an engine strong enough that it would leverage new and healthy housing as an adjunct. This, of course, is totally different than healing an existing community.

|

| Photo accompanying the Guardian article in April 2018 (Photo: Patrick Semansky/AP) |

How big? The revitalization program included 2,100 mixed income homeownership and rental housing units, 1.7 million square feet of life sciences research and office space, a new seven acre community learning campus with an early childhood center, a new public K–8 elementary school, food stores and retail amenities plus a community park. Even a new MARC station was envisioned. The total redevelopment was estimated to cost near $2billion (2003). The undertaking was touted as the nation's largest redevelopment project, the same claim that some make today for Port Covington.

A second birth defect of EBDI was that the redevelopment authority was organized as a quasi private entity, similar to the Baltimore Development Corporation (BDC). This governance model provides little democratic oversight, for example from the City Council. Even though two residents sat on the EBDI Board, most had to rely on SMEAC and eventually on the Annie E. Casey Foundation to find a voice in the process.

Broken promises

The trifecta of defects in assumption, approach and governance was compounded by the very first steps that EBDI took: Without much communication over 3000 frequently historic buildings were taken by eminent domain and then razed. Hundreds of residents who have stuck by their neighborhoods in hard times were displaced, many of them homeowners. A total of 740 families have been relocated, often forcefully. The demolition of every building in the initial 31 acres phase of the project destroyed not only whatever trust may have been still there, it was also a blatant violation of agreements made with the Maryland Historic Trust. Phase 1 looked exactly like another scorched earth urban renewal plan to displace people of color of the kind that was reminiscent of the destruction in the wake of Baltimore's infamous "highway to nowhere", exactly the kind of thing people had vowed to avoid. It would forever mark the entire undertaking.

|

| From a HUD brochure |

“It’s very hard to build relationships when the community is gone.” (Sean Closkey, ReBuild Metro working in Oliver and Johnston Square)In spite of the broad support from organizations, many goals were never met, at least not yet. SMEAC and Annie E. Casey eventually forced adequate relocation benefits which was good but required large sums that were subsequently missing in the rebuild (The homeowners received a $122,000 replacement housing payment, and renters received, on average, five years of rental subsidy). Casey showed in a post relocation study that relocated former Middle East residents were happy in their new places (80 percent of residents reported their overall quality of life as being a bit or much better), the drain of social capital was a big blow for the effort of rebuilding a community, which is fundamentally about people and not about bricks.

|

| In spite of these posters, the project frequently sputtered (Screenshot from Real News) |

The the biotech expansion of Hopkins as the engine for rebuilding a complete community sputtered also economically. The built in defects made the undertaking also economically less resilient. When the music stopped in the Great Recession EBDI was in dire straights.

The lack of governance and oversight had predictable problems: In 2011 the Daily Record published an investigative series titled “Too Big to Fail? Betting a Billion on East Baltimore" that found that "nowhere is there a comprehensive, independent public accounting of the funds and how they have been spent".

In the wake of the 2015 unrest Baltimore and with it EBDI became an international study object for inequity and social and racial segregation. A lengthy 2018 article in the British Guardian put the project into the larger Baltimore context and remains an interesting well researched read.

Throughout the various economic cycles, it remained easier to get hospital related commercial projects underway than to build more housing, a clear indication that the underlying project logic was flawed, especially in light of the overall relatively weak Baltimore housing market, the absence of sufficient funds for subsidies and the sad truth, that all the investment never succeeded to lift the home values to a point where they would pay for themselves.

|

| A Walgreens is part of a smattering of retail (Photo: Philipsen) |

15 years after take-off the project still about 40% incomplete. A 2018 report by the Federal Reserve found that public money investment was more than twice the private investment ($450 million versus $217 million) and that foundation expenditures almost equaled the private investment with $173 million. No rail hub materialized, nor did shops and restaurants except for a lone Walgreen, a 7-11 that initially rejected food stamps and a Starbucks.

The situation today

Fast forward two full decades after take-off and five mayors later, what was initially called "Middle East", then Biopark and eventually simply EBDI is now officially branded as "Eager Park", named after the 5 acre central park that Forest City pulled out of its hat in 2011. Regardless of name, it is still a work in progress large vacant lots remain in plain view of Eager Park. A number of committed projects is slated to begin soon, both on the Hopkins side and on housing. Hopkins has learned to speak the equity language.

It is inconceivable that Hopkins would remain a pre-eminent institution in a city that continues to suffer decline. (Ron Daniels, president of Johns Hopkins University 2018 as quoted in the Guardian)

The project has lost the attention it once had. Baltimore's leaders have set their eyes on new big shiny undertakings as the "game changers" that will turn Baltimore around: Pimlico in Park Heights, Perkins Homes/Somerset in East Baltimore and Port Covington in South Baltimore. One could say Baltimore suffered from kind of political ADD instead of seeing one large project through to the end and being able to use it is a stepping stone for the next, Baltimore leaves too many undertakings unfinished.

|

| Henderson Hopkins: A new school and library (Photo: Philipsen) |

As part of the planning process for the building, Vines Architecture toured Lacks’s neighborhood of Turner Station in Dundalk, met with the Lacks family and people in East Baltimore.(BBJ)

"We are on track to ensuring that 1/3 of the housing we develop are affordable. We are on track for ensuring East Baltimore and Baltimore City residents get jobs both construction and permanent jobs. We are on track for providing opportunities for local, minority, and women owned businesses to get contracting opportunities...and were making good on our promise to relocating residents...to help them return to eager park if they choose."(EBDI CEO Cheryl Washington in Jan 2020).

Disappointingly, the 62 page research paper doesn't provide a simple answer to the question of success or failure either; which isn't surprising, considering that the answers vary whether one is talking about commercial development, residential development, affordable housing, economic inclusion, workforce development or education, to name just a few of the tenets. The education component alone is so complex that it yielded its own book titled "Urban Renewal and School Reform in Baltimore". The new Henderson Hopkins school is also noted in the Theodos study.

The 550 student, $57.5 million school, co-funded by the Weinberg Foundation, was the first new school in East Baltimore in 25 years. But a lot of its revolutionary impetus already fizzled, both in the architecture as well as the pedagogy. The Theodos study finds that "96 percent of students in the school are Black. .., math test scores for the elementary grades are modestly above the Baltimore City Public Schools’ average, and for English, they are well above the Baltimore City Public Schools’ average, though in both cases they are still below the statewide average in Maryland."

Theodos like the Federal Reserve looks at the dollar value of the investments. Adjusted for inflation the project had invested only half of the envisioned investment volume by 2017. Over a third had gone to health and academic facilities, $150 million to demolition, acquisition and relocation, $120 million to infrastructure and parks, $85 million for a hotel and only $80 million for new housing(the last number excluding $64 million for student housing and a MICA center.)

In the demographic analysis much more remains the same than one would expect after so much displacement. Surprisingly, the population remained 88% black (down 8%) and average income has also remained almost steady ($45k to $40k) if adjusted for inflation, whereby income is somewhat distorted by the students now residing in the area. Overall total population as of 2019 still remained below old levels (16,650 in 2000, 12,601 in 2019).

Startingly, given the usual emphasis on homeownership as an indicator of neighborhood stability, the rate of homeowners fell from 18% to 7%. Some projects still in the pipeline are for homeowners and may change the ratio. The fact that home values increased significantly (from $40k to $130k in today's dollars) would become more relevant if more homeownership would contribute to wealth creation in disadvantaged demographic segments. As noted, after 20 years the home values remain insufficient to develop new units without subsidies. Theodos is careful with a final judgement in terms of success or failure.

|

| The Forest City masterplan (2011) with a large park |

What do former participants say?Without conclusive answers from the latest study, I turned to two early activists and participants in the process to get their verdict.

Kathryn Madden, a MIT trained urban planner and architect who worked as a consultant with Sasaki Architects on the planning phase that immediately followed phase one. My firm ArchPlan was a sub consultant and our work consisted in masterplanning phase two with significant "preservation strategies". .

|

| After (Photo: Philipsen) |

|

| Before (Photo: Philipsen) |

Yet, in reminiscing about the community meetings we attended in planning phase two with the clear objective of preserving houses instead of demolishing them, she remembers that residents clearly said they didn't want large green spaces which they considered dangerous. "They wanted small intimate gardens, defensible green spaces and pocket parks", Madden recalls. "The [Eager] park is a disaster", Madden burst out, clearly incensed how flagrantly it is in conflict what residents had asked for and how much Forest City as the master developer imposed its own idea after our planning work was done. She toured the area last in March 2020 and didn't see people out and about, not in the park and "not on the stoops", something she puts in contrast to what she observed in the areas around the piano, where disinvestment persists but people where out and visible in their neighborhood.

Madden also mused about the role of planners who come in for a limited time trying to build trust. She recalled the woman who asked "should I fix my furnace or not"? "We then tried to show areas of preservation where rehabilitation would be desired, but didn't have the power to ensure that this would be actually done" Madden says. She uses EBDI frequently as an example in teaching at the Harvard graduate school for design.

Brad Rogers, whom I quoted in the beginning of this articles is now heading up the South Baltimore Gateway Partnership in their large effort of revitalizing the communities near the casino with the help of proceeds from the casino funds, was involved in the EBDI process as a young staff member. While he admits he hasn’t been directly involved in a long time, he suggests that the project might have advanced more quickly if it had built from strengths in the original community, rather than trying to create a blank slate.

|

| Undeveloped parcels: Hopkins, still a wall beyond (Photo: Philipsen) |

“We don’t have to pretend there’s a stark choice between creating new development and strengthening historic communities. The best approach takes advantage of both simultaneously. We need to learn how to leverage existing assets to support new investment, and vice versa.” He sees his current work as a successful approach in which everyone is "working from within the existing communities" to network everything together with the Middle Branch as the connecting armature. Work to date is less focused on the shiny Middle Branch waterfront itself and instead begins deep inside the communities with projects such as the new rec center in Cherry Hill with eventual easy access and linkage to the amenities of the Middle Branch.

|

| Eager Park opening: really a reason to celebrate? (Photo: Philipsen) |

What Madden and Rogers taught me that asking about success or failure is the wrong question, that things aren't always binary, that the beginning and end are fluent and that even baked in flaws can be compensated over time. EBDI is not a case of gentrification, nor is it a citywide "game changer". It isn't a flagship of successful urban renewal but a show-case for the complexities of urban repair in a highly segregated and shrinking city.

Klaus Philipsen, FAIA

Previous Blog article on this blog:

The East Baltimore EBDI Development - Success or Failure?Expected developments:

Apartments: https://www.bizjournals.com/baltimore/news/2022/10/27/apartment-tower-planned-east-baltimore-junica.html Marren Architects

Henrietta Lacks Building: https://www.bizjournals.com/baltimore/news/2022/11/10/johns-hopkins-university-henrietta-lacks-building.html?utm_source=st&utm_medium=en&utm_campaign=ae&utm_content=BA&j=29661756&senddate=2022-11-10

Mayson Dixon townhomes: https://www.bizjournals.com/baltimore/news/2022/05/20/mayson-dixon-townhouse-development-ebdi.html

EBDI studies/reports

Urban Institute, Baltimore neighborhood investments: https://www.urban.org/sites/default/files/publication/102976/neighborhood-investment-flows-in-baltimore_1.pdf

Urban Institute EBDI: https://www.urban.org/sites/default/files/2022-10/The%20East%20Baltimore%20Development%20Initiative.pdf

Urban Institute, EBDI: https://www.urban.org/research/publication/east-baltimore-development-initiative

urban.org/research/publication/east-baltimore-development-initiative

Annie E Casey, EBDI: https://assets.aecf.org/m/resourcedoc/ACEF-EastBaltimoreRevitalization_2011.pdf

Casey paper: As of December 31, 2010, EBDI had awarded $181.7 million in contracts. Minority and women-owned companies received 24 percent of the $25.4 million in design contracts and 40 percent of the $143 million in construction contracts. (See Appendix A for a breakdown of these figures; Appendix C provides a breakdown for key individual construction projects.

Federal Reserve, Richmond: https://www.richmondfed.org/-/media/RichmondFedOrg/publications/community_development/practice_papers/2018/practice_papers_2018-3.pdf

EBDI CEO resigns: bizjournals.com/baltimore/stories/2009/02/02/daily36.html

Feb 4, 2009 Updated Feb 4, 2009, 3:04pm ESTJack Shannon, one of the leaders of the massive redevelopment near Johns Hopkins Hospital, will step down as CEO of East Baltimore Development Inc. on April 30.

Shannon joined EBDI six years ago to help the nonprofit organization spearhead the ambitious $1.8 billion residential and biomedical research project just north of the hospital, expected to revitalize the neighborhood and bring jobs to the city.