|

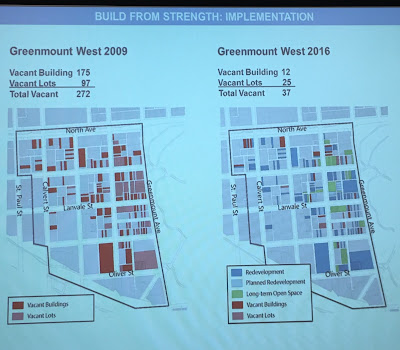

| Greenmount West progress: Not only on the waterfront. (TRF) |

The cranes all over downtown, on the waterfront and even in Remington, Hamden, Poppleton and the upper Westside that give the usual Baltimore observer so much hope are nothing but the light from stars that was emitted years back, when the initial investor spark set the energy in motion. Those projects were set in motion at a time before the Baltimore unrest, before the uptick in crime, before the uncertainty about the school budget and definitely before Washington became set to turn off many of the funds that have kept Baltimore afloat to date.

On the occasion of a 40 year anniversary training course about the Community Reinvestment Act (CRA) held at the Federal Reserve on Sharp Street, Seema Iyer showed that neither crime nor schools are as much a barrier for newcomers to move in than vacant houses. Once a neighborhood exceeds 4% vacancy, nobody wants to move in anymore her data show. Nobody doubts that it is one of Baltimore's biggest challenges to fill the many vacant houses again. To that end, community reinvestment is certainly key and at the CRA event bankers from BB&T, M&T, PNC and TD (Toronto Dominion) were on hand (Harbor Bank was invited but had a conflict) to explain how they respond to the challenges of the CRA on the one hand and the ongoing community disinvestment on the other.

|

| The infamous red line map of 1937 |

Comparing the infamous Homeowner's Loan Corporation redlining map of 1937 with today's vacant houses map it would be easy to conclude that the 1977 Community Reinvestment Act was a failure. After all, it had specifically been enacted and made law to avoid such redlining in the future and force banks to provide loans without discrimination.

In fact, there was considerable rumbling from community leaders in the room about the lending rates of the two major banks in the Baltimore area when Diane Bell McKoy, CEO of the Associated Black Charities noted that Bank of America provided only 6% of its loans to African Americans in 2016, the second largest bank in Baltimore is M&T which fared slightly better. The two largest banks control about 70% of the Baltimore market. Wells Fargo and PNC rank #4 and #5 in size respectively, in total 27 banks are represented in the Baltimore area market.

|

| The vacancy map (BNIA) |

For example how the TRF Development Partners and Sean Closkey collaborated with TD and other banks to rebuild Barclay and Oliver, two of Baltimore's shining examples of strategic investment and fund pooling.

Or when Healthy Neighborhoods loan officer Rahn Barnes spoke about his collaboration with PNC and the effort of creating a $10 million investment fund. PNC's Christopher Rockey admitted that communities currently have a hard time to work through the thicket of information and groups that can provide access to capital. "we need a point of entry for capital" and "need to market as a community and not as banks" he said, exactly what Healthy Neighborhoods is trying to do with their fund. Healthy Neighborhoods President Mark Sissman was in the audience.

Where Closkey's success in Barkley and Oliver meets Baltimore's conundrum of population stagnation or loss is the issue of strategy. Too much money in Baltimore is wasted on initiatives and development that is not strategically placed, is not creating value and is not coordinated in a larger context. An example was last year's Baltimore Housing RFP for the redevelopment 40 acres in the middle of Park Heights. Not associated with a point of strength, not connected to stable areas and not based on any type of market or even the creation of a market. Closkey says investment has to create a ladder. Development needs back-stops and it needs anchors. "It isn't about the number of units built it is about what community is left behind", he says. He pointed to the Patterson Park CDC. Yes, he admits, the CDC failed in the end, but what Ed Rutkowski left behind is a stable and healthy community, a lasting value. BNIA's 4% finding sets a target. Lowering vacancy from 50% to 40% is a huge effort with little tangible result especially in a large area. Lowering vacancy from 7% to 4% is much more doable and may set an area on a course to success.

|

| The bankers table: From right: Sean Clauskey (TRF), Donna Grigsby (TD), Janice Wiliams (BB&T), Joseph Jones (Center for Urban Families), Christopher Rockey (PNC), Rahn Barnes (Healthy Neighborhoods) |

If Baltimore" community development corporations, neighborhood activists and government agencies would finally align themselves around those ladder-of-value-creation strategies that result in self sustaining outcomes, then Baltimore's banks and financial institutions may actually be willing to pool enough capital to get those projects started that begin "re-winding the clock" as Closkey puts it. That the regional influx of new residents has slowed to a trickle and may completely subside thanks to unwise and immoral immigration policies is not helpful but will make strategic collaboration even more important.

Klaus Philipsen, FAIA

|

| Correlations of crime, schools (low) and transportation and vacancies (high) and population change (BNIA) |

|

| BNIA data |

No comments:

Post a Comment